Why tech companies entered the car industry

Ever since the introduction of the iPhone and Apple App Store in 2007 and 2008, our digital lives center around apps. These are available on any device, from phones to TVs. Though, despite the fact that it's been almost 15 years since the app store was introduced, there are only a handful of cars on the market today that support the popular media and navigation apps.

There are two reasons for this. The first one is technical constraints. Most infotainment systems are built using a version of Linux or BlackBerry's QNX. Each carmaker has its own custom software stack. An app that runs on carmaker A's system therefore won't run on carmaker B's system. It makes no sense for a company like Spotify to invest time and money into making their app work on every separate system.

In the case of navigation, it is more complex. Navigation software is not offered for free to carmakers. They have to license the software. So next to a technical issue, it becomes a cost issue as well. Consequently, many carmakers have an invested interest in mapping companies to have more control and better deals. HERE Technologies, for example, is majority owned by a consortium consisting of Audi, BMW, and Mercedes. Unfortunately, those are often not up to the same standard as Google Maps or Waze.

So you end up with the situation where consumers would much rather use their favorite apps but they are not available in cars. Naturally, tech companies were paying attention to this.

Mobile mirroring

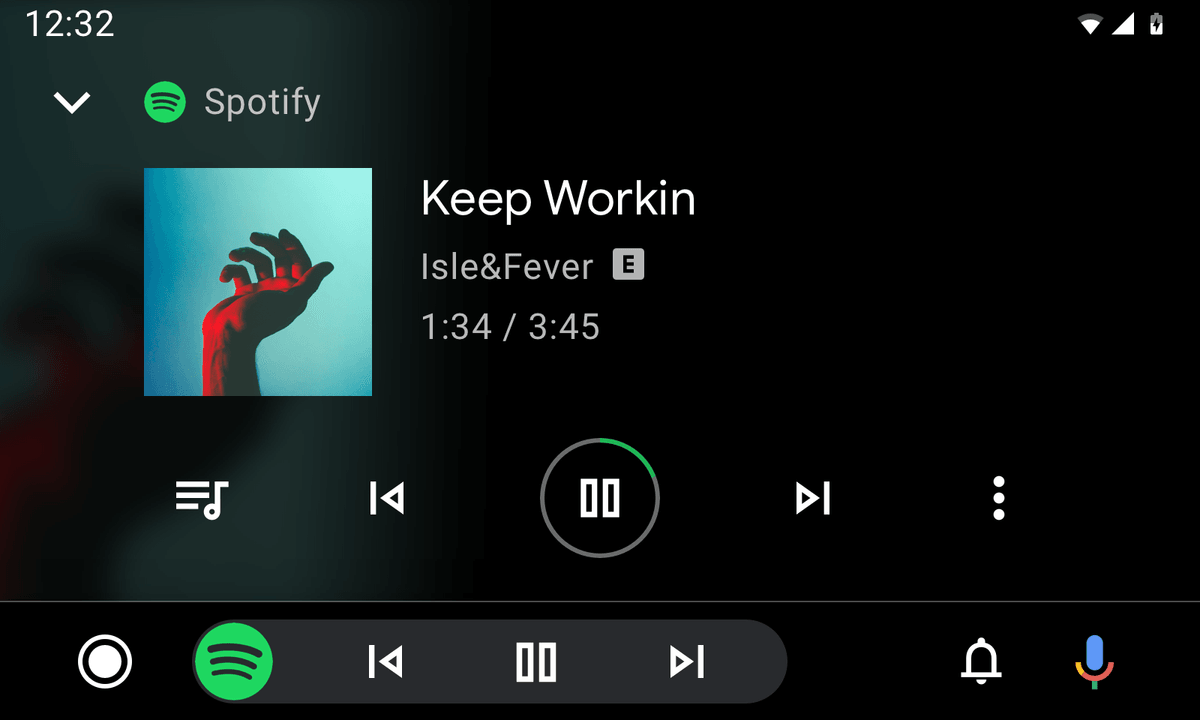

The first step by tech companies into the car industry came in the form of phone mirroring. In 2014, Apple announced CarPlay, a standard for mirroring iOS in the head unit of the car. A year later, Google announced Android Auto, their equivalent to CarPlay. Both systems are very basic, offering a small selection of apps only relevant for driving. Only certain categories of apps are allowed to be used while driving, such as navigation or media.

Apple and Google created templates that restrict the design and functionality of the app to minimize distraction. Developers have to use these templates. They are there to ensure a uniform experience so that drivers can rely on muscle memory to navigate the apps.

Although the number of available apps is limited, both systems do exactly what customers want. You can use your favorite apps, there is no need to log in anywhere else, the design is familiar, and to stay up-to-date you only need to update your phone. Despite the car aging, the software is always up-to-date.

It is no surprise then that consumers love CarPlay and Android Auto. In the case of CarPlay, according to a 2018 research by Strategy Analytics, only 4% of consumers prefer to use the carmaker infotainment over CarPlay. 34% only use CarPlay and 33% of respondents say they mostly use it.

Realizing this, at WWDC this year, Apple presented the next generation of CarPlay. It will soon be able to take over all in-car displays, not just the head unit. This means it will include more car-related features like climate controls. Theoretically, a driver does not have to interact with any native software anymore while driving. There will be a level of customization for carmakers to theme the interface but it is unclear how much at this point.

It is not hard to imagine that Google will soon follow a similar path with Android Auto. But Google has made perhaps an even more powerful move, in the form of Android Automotive OS.

Android Automotive OS

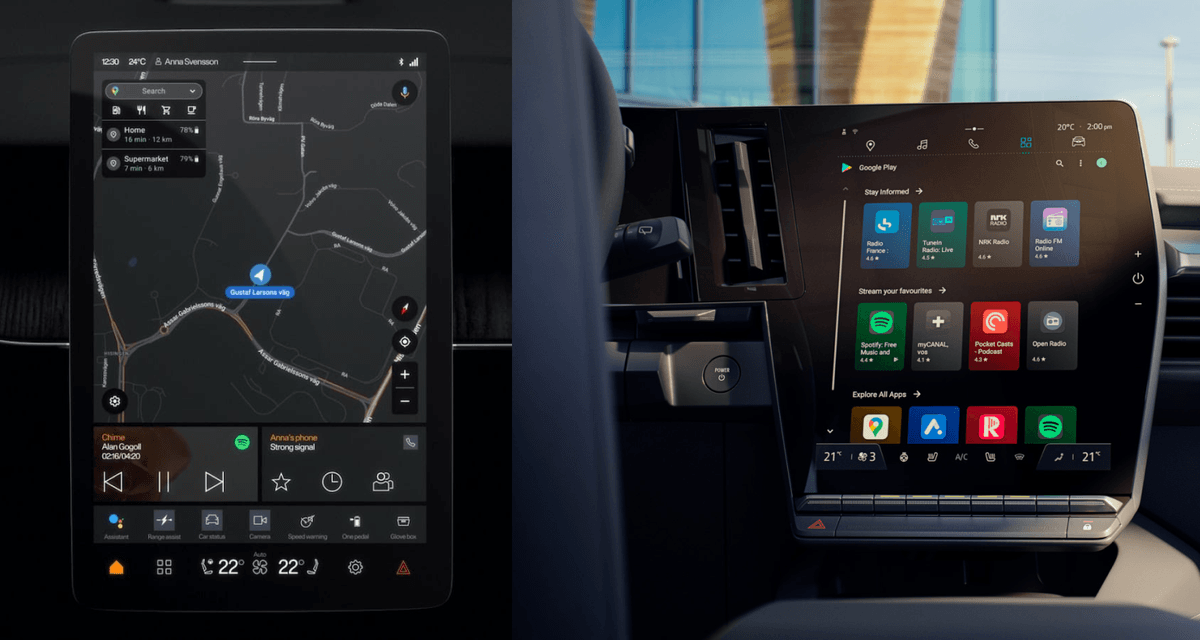

In 2017, Google released a version of Android specially aimed at cars. Instead of mirroring a phone, Android Automotive OS (AAOS) runs natively inside the car. It sits on top of the real-time operating system of the car and aims to replace the closed, custom system of carmakers. Android Automotive OS is very similar to the Android version that runs on smartphones and tablets. By switching to Android Automotive, carmakers have access to the huge Android ecosystem of apps, developers, and service providers. But unlike Apple CarPlay and Android Auto, AAOS allows carmakers to have different degrees of control over the design and features of the infotainment system.

It is no surprise then that many carmakers have announced the switch to Android. In doing so, they face an important choice. Out of the box, AAOS does not include an app store, navigation system, voice assistant, and other services. Carmakers can choose to get these from Google through a licensing deal for Google Automotive Services (GAS), or use non-Google services. Both have different advantages and disadvantages.

Google Automotive Services

Google Automotive Services (GAS) includes the Google Play Store, Google Maps, and Google Assistant. It is an attractive offer to carmakers because one single license deal will give them all the services they need.

The provider of the app store not only delivers a marketplace for apps but is also responsible for moderation and, to some extend, the interaction between the driver and the app. Therefore, Google enforces the same templating system for apps on AAOS as it does on Android Auto. An app that is adapted to Android Auto can work on AAOS as well with minor changes. Though, not all categories of apps are available yet. For example, messaging apps are available for Android Auto but not for AAOS.

One disadvantage for carmakers is that Google products are not as popular in some markets, or even blocked, like in China. Google also sets a couple of minimum requirements for example in terms of hardware performance and software testing. Business wise it is a tricky situation because it is not the cheapest option. Carmakers will depend a lot on Google so they won’t have much bargaining power. For example, Google could raise its prices or enforce new rules or requirements. Carmakers also don’t have much say over the roadmap of Google Maps and the other services.

Currently, Polestar, Volvo, Renault, and GM have cars on the market with GAS.

Non-GAS

The second option is to find non-Google services. The core advantages are flexibility and cost. Carmakers are only constrained by technical limitations so they are free to design and build the system exactly as they want. They are not stuck to one supplier so they can choose which services to partner with and relatively easily change between them. Consequently, they can even adapt the services to different markets.

It does require a lot more time and effort to partner with a separate app store, navigation service, voice assistant, and others. Finding an app store is the most important. There are a couple automotive suppliers, like Faurecia Aptoide and Harmann, who have realized the potential of app stores and started their own. They will likely use the same templating system as Google so developers don't have to create separate versions of their apps.

But apps like Google Maps and Waze will presumably not be available. This is tricky because those are the most popular navigation apps. But that doesn't mean they are the best. Unlike with Google services, carmakers have an opportunity to partner with a provider and have a real influence over the product.

Currently Rivian and Lucid are the only brands with a non-GAS system. Many premium brands will likely opt for non-GAS.

Why it matters

There are a handful of startups carmakers that don't build their own system and only rely on CarPlay and Android Auto for music and media. Considering it is really expensive to build and consumers rather use phone mirroring, why do carmakers still bother to make their own?

The first reason is that in the coming years, it is unlikely that CarPlay or Android Auto will be able to take over all in-car controls. Brands like Mercedes, for example, have a wide range of unique features ranging from massage seats to custom sunroof settings that are unlikely to be covered by CarPlay.

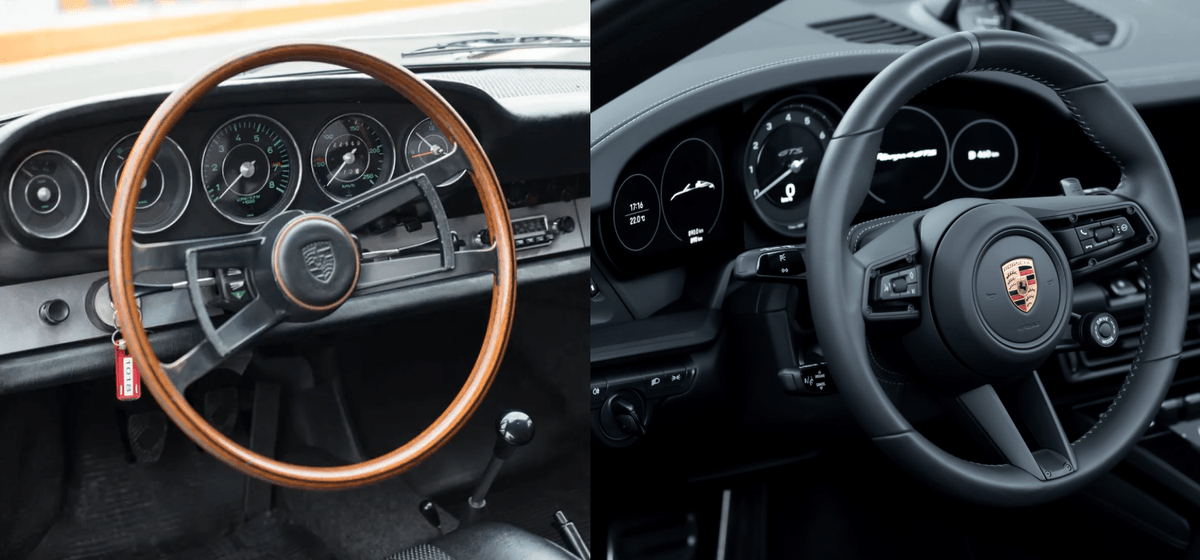

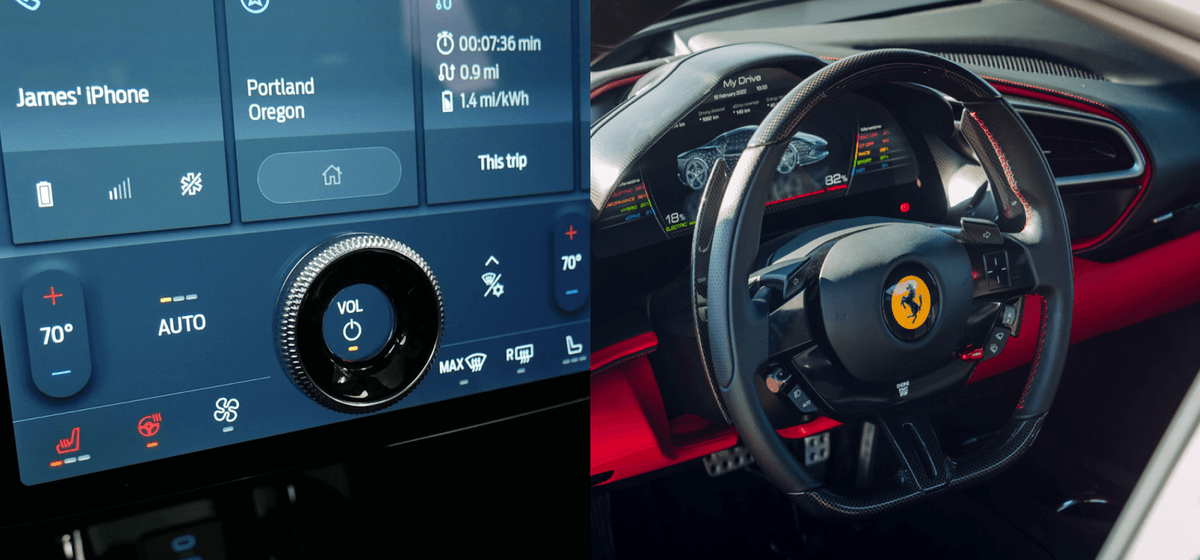

From a design perspective, carmakers want control over the whole experience. CarPlay will standardize the in-car interaction between all brands. No matter whether you are in a Toyota or a Porsche, the climate controls will be the same. For consumers, standardization is great in a lot of driving cases. It is convenient that turn signals are always in the same place. But you can question whether having, for example, touch-based climate controls is the safest interaction.

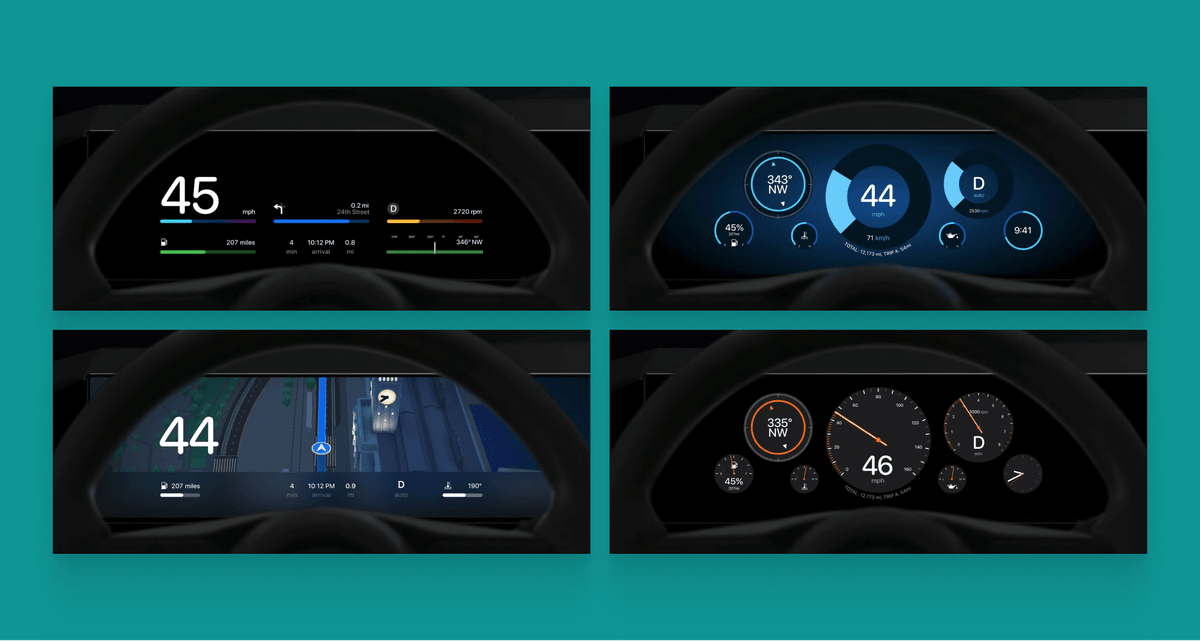

If a carmaker wants to research ways to improve in-car interaction, it will likely not be supported by CarPlay. Similarly, carmakers use novelties like head-up displays, fancy graphics, and 3D animations to differentiate themselves from the competition and show off how 'innovative' they are. Whether it is useful or not, an infotainment system is a way to differentiate yourself from other brands.

Furthermore, it is not clear yet how much customization Apple will allow but it is likely much less than what carmakers want. This is a problem for a brand like Porsche, for example. Ever since the first 911, the instrument cluster has consisted of five gauges. Porsche wants to keep this heritage and it is unclear if Apple will support that.

Perhaps most important, carmakers are desperate to find new revenue streams. Consultants are whispering into their ears that you can make lots of money with in-car software. So far their attempts have been a bit crap and met with a lot of resistance. But seeing as how Google and Apple make lots of money with their app stores, there is an opportunity there. Think of paying for charging from the car, ride-sharing, or useful over-the-air upgrades.

Can carmakers compete with phone mirroring?

Carmakers have lost most of their customers to Apple CarPlay and Android Auto. In the coming years, it will become clear whether those systems will take over or whether carmakers can win them back with their native systems. I don’t think it is too late for carmakers to win them back. The key will be to build a superior infotainment system but Android Automotive is the only way to achieve that.

What CarPlay and Android Auto do exceptionally well are the most frequent use cases: media and navigation. I can look up a route on my phone, download playlists and podcasts, get in the car, and set off. To compete with phone mirroring, a native infotainment system has to be able to do this at least as well.

Using GAS will mean you can offer the most popular services and get very close to the phone mirroring experience. But non-GAS carmakers will have to invest in navigation services that can rival Google. Which is possible. Google Maps and Waze are popular, but there is plenty of room for improvement. For example, it is not possible to send a route from Google Maps on the phone to Google Maps in the car. More generally, core driving-related parts like route planning, parking, or a deep integration with the charging network are also mediocre. You often have to use different apps for this. Carmakers can collaborate closely with mapping companies to make this happen and offer a superior experience over Google services.

Another area where carmakers can offer a better solution than phone mirroring is the integration with the rest of the interior. An infotainment system is not a standalone product, but a part of the interior. In the near future, drivers will have to switch between phone mirroring and the car's system to interact with the features that aren't supported by CarPlay. This is a crappy user experience.

CarPlay supports the basic controls not because they are the best, but because they are the most common. Carmakers have the freedom to explore different screen layouts, different interaction modes, and different features to offer a better user experience.

Similarly, carmakers need to think about how to interact with the car at a distance. Companion apps are an afterthought today. But carmakers need an answer to the total ease of use of looking up a route on your phone, downloading some playlists, and having everything ready when you enter the car. I'd much rather have everything in one good companion app than have to switch between several apps.

How I see the future

The question is not whether AAOS can offer a better experience than phone mirroring, because it can, but if carmakers can actually design and build a better system. Aside from the app ecosystem, what makes CarPlay and Android Auto so popular is that they offer the core functions of an infotainment system in a familiar design. And nothing else. They are really easy to use because they are simple.

At the same time, carmakers' systems come with hundreds of features, flashy graphics, 3D animations, and other stuff that looks great on a car show, but just adds unnecessary complexity. Carmakers don't understand that quality is better than quantity and they overestimate how much consumers care about the infotainment system. What is the point of pouring millions into developing all these features when nobody uses them?

The real power comes from offering superior services and simple, intuitive design. Hopefully, the competition with phone mirroring will wake up carmakers and see that they have been focusing on the wrong things. Though, from what I'm seeing inside the car industry, I’m skeptical of carmakers being able to change fast enough. Therefore, Apple's move to take over all in-car displays with CarPlay is risky but may pay off.

The difficulty is that they depend on carmakers to build this into their cars. And aside from Polestar, most have not shown a willingness to do that. Watching back Apple's keynote presentation, it's obvious that it was a sales pitch for carmakers to adopt the new version of CarPlay. With statements saying how 79% of US buyers only consider a car with CarPlay and a slide with logos of carmakers who are allegedly already on board.

It is questionable how convincing it was. Despite showing Mercedes' logo, in a recent interview with The Verge, Mercedes CEO Ola Källenius was more hesitant, saying 'What we will do with them, we will see. Our goal is clear, a Mercedes experience through and through'.

It is clear that tech companies have taken over in-car software. The question is, will the future be phone mirroring or Android Automotive? It will be interesting to see if consumers will choose a Polestar over another brand because it comes with CarPlay. If carmakers don't radically change their approach towards infotainment and focus on offering superior core functions and design, they will lose out to phone mirroring. The car industry only has a few years to figure this out or risk losing control of all in-car software.

Get notified of new posts

Don't worry, I won't spam you with anything else